One of the biggest mistakes new crypto investors make is looking at coins by price per coin and comparing them. You need to understand the crypto market cap before making trading decisions. This will allow you to better evaluate the potential growth of a particular token in comparison to other known tokens and the market at large.

What is Crypto Market Cap?

Market capitalization, or market cap for short, is the total value of a particular coin or token in the market. To put it simply, it’s the number of tokens in circulation multiplied by the price per token. Knowing the market cap of a coin gives you a much better understanding of how it fits in the overall market and how much growth potential a coin has.

To give you some perspective, the total market cap of all crypto is about $2 trillion. Bitcoin holds a majority of the market with a market cap of around $814 billion at the time of this post (9/26/2021). You can use a site like coinmarketcap.com to get details about most cryptocurrencies.

Why You Don’t Buy on Price Alone

The common mistake that many crypto newbies make is trying to find coins that are “cheap” by looking at the price per coin. The logic is often that if you can buy a crypto at $0.01, then you can make a killing when it hits $1.00.

If you’ve ever stumbled into the world of crypto on social media, you’ll see a lot of uninformed “influencers” pawning these low-priced coins. For example, I recently saw a TikTok video where someone was doing a calculation to determine just how many millions of dollars you would have if Shiba Inu hit $1 per coin.

What they never point out is that it’s virtually impossible for a coin like Shiba Inu to hit $1 per coin.

Example 1: Shiba Inu to $1

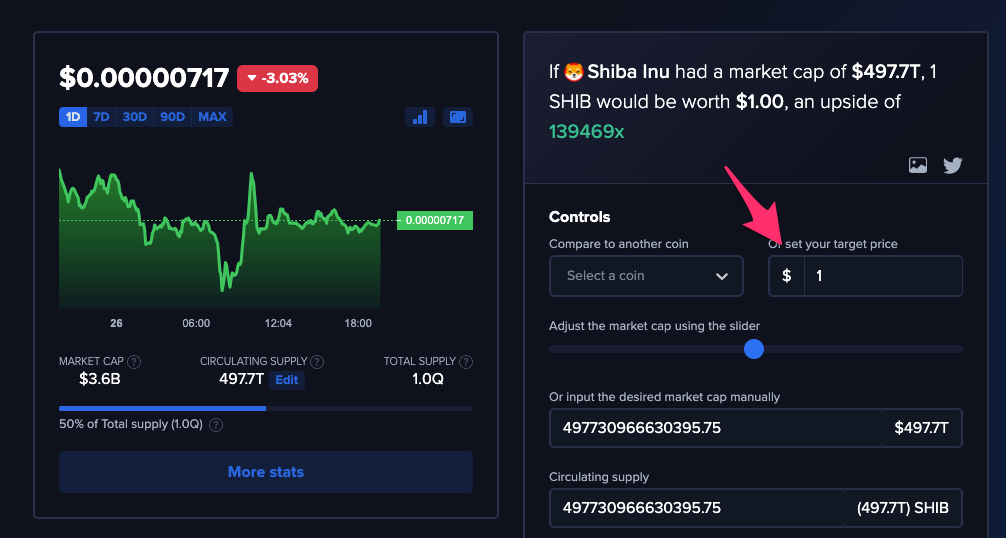

Let’s take a look at how the math works out to get to $1. Shiba Inu is around $.00000717 per coin at the moment. If it hit a dollar you would be holding over $140 million dollars, but like I said it’s not possible. I know it’s not possible because I examined the market cap of Shiba Inu. You can use a tool like The Coin Perspective to compare cryptos on their market cap. What I’m going to do is select Shiba Inu as my token, then fill in the field for “Or set your target price” and set it to one dollar.

As you can see, to hit a price of $1, Shiba Inu would be worth a market cap of $497 trillion. Bitcoin was the only crypto to ever hit a $1 trillion market cap and it’s since fallen below that mark. In order for Shiba Inu to hit $1, it would have to be worth over 500x Bitcoins market cap. That’s literally impossible.

The entire market cap on the U.S. stock market is about $47 trillion. So these social media “experts” are suggesting that a meme coin would be worth more than 10x all of the companies that trade on U.S. stock markets. If you cannot understand how insane this is, then I don’t know what more I can show you.

Example 2: Cardano Meets Ethereum

Let’s say you’re super bullish on Cardano, and think that it could meet the current market cap of ethereum. Cardano is trading at $2.26 today, so what is the price point that it would match Ethereum? The market cap of Etheruem is about $361.3B at the time that I am writing this.

We can use the same calculator to do this. This time I select Cardano and select Ethereum in “Compare to another coin”. The calculator does everything for us and the result is that we know, in the extremely bullish scenario that Cardano reachest Ethereums current $361.3 billion market cap, each ADA token would be worth about $11.27.

What are the Different Categories of Crypto Market Caps

In the crypto market, we typically categorize different coins into small, mid, and large-cap coins. Your large market cap coins are the likes of Bitcoin, Ethereum, Cardano, Binance Coin, and XRP. There is no hard definition to where these coins are categorized, but I’d say a good rule of thumb is that a market cap over $2b is a large-cap.

The next level is the mid-cap tokens. These are cryptos with a market cap of probably a couple hundred million to a couple billion. I’d say that tokens like SushiSwap, Ren, Curve, Nexo, etc.

Then you have small-cap tokens that are under a couple hundred million. A lot of these tokens are going to be ones that you haven’t heard of, and are starting to grow and show some signs of life but do not have the adoption of the mid to large caps yet.

Ok, there’s one more tier of super-low cap coins that I’ll refer to as “Shitcoins”. You can find a lot of these in the newly listed crypto section of CoinMarketCap. These are coins that might be worth a couple hundred thousand dollars to a couple million. You’ll find a lot of scam coins here, but there are some gems that have real growth potential.

What Cap Should You Invest In?

There are different schools of thought on which coins to target. For example, large-cap coins are the most proven and if the entire crypto market grows, they will see some decent growth. These are the “safer” bets in the crypto market.

The mid-cap tokens are showing signs of adoption and usually are backed by well-known investors and can be trading on popular exchanges. These tokens are somewhat stable but have a much higher upside potential than the large-cap tokens.

Then you have the small caps. Most of these projects are just getting off the ground and are really not proven. If you can get into one of these small-cap tokens early, you can make insane gains. As we move down the tiers, the risk gets higher though. Trying to weed out good projects is more difficult and takes much more due diligence.

Then you have the shitcoins. The thing is, these coins have the potential of massive amounts of gains. I’m talking up to 1000% gains but the risk is super, super high. A lot of the coins that fall into this category are scams or “rug pulls”. A rug pull is where a nefarious actor hypes up a crypto and gets everyone to start buying it. They hold the majority of tokens and as the price rises, they sell out the majority of tokens at the peak. This causes the price to plummet and everyone is left with worthless tokens except the rug puller who made out. We call these people who lose “bag holders”.

The point here is to be super wary of investing huge amounts in shitcoins. Sometimes they work out and those are the stories that get published. You don’t hear about the millions of bag holders out there. The winners are coins like SafeMoon. If you put $1,000 into this shitcoin early, when it had a market cap below $5m, and then sold at the peak, you could have ended up with over $11m.

Conclusion

Use the tools at your disposal to understand the growth potential of a crypto. The Coin Perspective is my favorite tool and I also spend a lot of time on CoinMarketCap doing research. Make your decisions on market cap, not coin prices.