There are a lot of options out there for Decentralized Exchanges and many new ones launching. However, today I’m going to talk about why PancakeSwap is one of my favorite DEXs.

What is a Decentralized Exchange (DEX)

Many of my readers are new to crypto, so I wanted to give a brief explanation of what a Decentralized Exchange is in the crypto world. The core idea behind a DEX is that it’s a peer-to-peer system. With centralized exchanges, like [eafl id=”1268″ name=”Coinbase” text=”Coinbase”], [eafl id=”1273″ name=”Gemini” text=”Gemini”], or [eafl id=”1269″ name=”Binance.us” text=”Binance”], there is a company facilitating the trades and controlling your wallet on their infrastructure. Centralized Exchanges have control of their own order book. The main theme here is that there is a centralized company controlling the trading. The main benefit of centralized exchanges is that it’s easy to convert between fiat, like the US dollar, and crypto.

Decentralized exchanges like PancakeSwap offer many of the same features that centralized exchanges offer and more, but these functions are not really controlled by the company. The DEX does facilitate the trade between users and collects a fee, but there is no real control. The funds are not held in a wallet that the exchange controls, rather they are held in a private wallet that the user owns.

On decentralized exchanges, the tokens don’t need to be approved to be traded. Basically, anyone can add a token and trade it to other users, assuming that there is liquidity or supply of that token in a pool to trade from. DEXs also don’t require a KYC (Know Your Customer) registration. So they are more anonymous, though if someone can tie you to your wallet address they will know your trade history.

There are advantages and disadvantages of each type of exchange, but I’m not going to go much further in this post. Just know that PancakeSwap is a Decentralized Exchange.

What is PancakeSwap?

As I said, PancakeSwap is a Decentralized Exchange that allows users to trade, or swap, one coin for another. PancakeSwap is a type of DEX that we call an AMM or Automated Market Maker. This means that there is, essentially, no order book. The trades come from liquidity pools that are funded by other users. When you trade one token for another on PancakeSwap, liquidity is moved from one side of the pool to the other.

I’m not going to go super in-depth into liquidity pools but think of it like this. You hold two tokens, BNB and CAKE. You want to add to a liquidity pool for BNB/CAKE. The reason you would do this is to earn trading fees on the exchanges that happen in the pool. Anyway, let’s say you add 1 BNB and 2 CAKE to the pool and also assume that is the total amount of tokens in the pool. Then the price is currently .5 CAKE for every 1 BNB. If someone decides to trade some CAKE or BNB, the ratio of the pool changes, and therefore, the price per token changes. The pools are what the users are swapping.

PancakeSwap is on the Binance Smart Chain (BSC)

The Binance Smart Chain is a blockchain network that allows you to trade Smart Contracts. The tokens that I’m talking about trading on PancakeSwap are considered Smart Contracts. I will go more in-depth into Smart Contracts in another post.

Binance Smart Chain is a fork, or basically a copy, of the Ethereum blockchain. This means that the BSC team, basically, took the code for Ethereum, made some changes and improvements, and launched their own network. When we talk about tokens trading on the Binance Smart Chain, you will sometimes see them referred to as BEP-20 and Ethereum smart contracts are sometimes referred to as ERC-20 tokens. Just know that those numbers and names are different networks and you cannot trade a token directly from one blockchain to another without converting between networks.

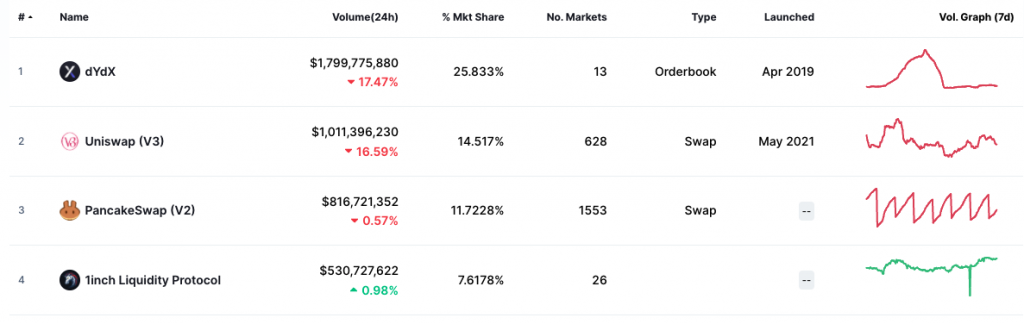

The main thing that you should know is that the Binance Smart Chain is way faster and cheaper than Ethereum. On these networks, you pay a gas fee to make a transaction. This fee goes to the miners or the validator nodes on proof-of-stake networks. The important part here is that moving $100 worth of a token on the Ethereum network might cost over $100 in fees depending on the network usage at the time. On the BSC network, a transaction for the same amount would probably cost a few cents. These prices make Ethereum DEXs, like Uniswap, no fun for me, but I can make several trades on PancakeSwap without going broke on fees.

What are the Features of PancakeSwap?

PancakeSwap is a platform that allows many more actions on top of swapping tokens. It also has a huge community and is probably nearing 3 million active users at this point. Many people are attracted to PancakeSwap because of the low fees, amount of services offered, the community, and the branding really seems to resonate with people. It really feels “fun” to use. It is the #1 DEX on the Binance Smart Chain. Now let’s talk a little bit about what you can actually do on PancakeSwap.

Exchange

The exchange is the main function of PancakeSwap. This is where you can swap one token for another. This is how you buy or sell a token. For example, you might buy CAKE with your BNB tokens. Then CAKE goes up in price significantly. You can then sell your CAKE and receive BNB back. Then do whatever you want with the BNB including cashing it out on a Centralized Exchange.

Syrup Pools

Syrup Pools on PancakeSwap allow you to stake your tokens to earn interest in either that same type of token or another type of token. On proof-of-stake blockchains, tokens are staked to essentially verify transactions on the network. Fees are paid to those validators. So you can basically earn interest at relatively lower risk by staking your tokens in a Syrup Pool.

Yield Farms

These are the liquidity pools that I was talking about that make PancakeSwap an AMM. PancakeSwap yield farms allow you to provide liquidity by sending a pair of tokens to a farm pool. You earn money on trading fees when these tokens are swapped by other users. It’s a way to earn extra money on tokens you don’t plan to sell any time soon, but you are exposed to something called “impermanent loss”. Google that if you’re interested, but essentially large shifts in the supply of one token vs the other can cause you to lose money.

Initial Farm Offering (IFO)

In an Initial Farm Offering, you gain access to a new token that is launching on PancakeSwap. When you stake CAKE-BNB tokens, you’re given another token called the PancakeSwap LP Token. So you can use these CAKE-BNB LP Tokens to apply them to a newly launching token in an IFO. You’ll receive a fraction of the newly launched token as part of this. This is a way to get into a token before it’s launched publicly with the hopes that the price will increase drastically after the public launch.

Lottery

The PancakeSwap lottery is another fun idea. It works basically the same way traditional lotteries work. You spend CAKE tokens to enter the lottery with a chance to win more CAKE tokens. Right now, the pool for the current lottery is about $250k in CAKE tokens. In version two of the lottery, the drawings happen every 12 hours.

The thing to note about the lottery is that you must match the numbers in the correct order to win. You can win anywhere from 2-40% of the total pool depending on how many numbers you match. If you match all 6 in the current pool, you would win about $135k. I’m sure that the odds of winning the CAKE lottery are much better than the Powerball or MegaMillions drawings.

Another thing about the lottery is that 20% of the tokens that are sent to the lottery pool are burned. This means that they are destroyed forever. This helps to control the inflation level of CAKE as new CAKE tokens are constantly minted. The lottery acts as a deflationary mechanism in this case.

Prediction

The prediction section of PancakeSwap is both fun and dangerous. This is straight-up gambling to me. You have to predict the price change of the BNB token within the 5 minutes that each prediction round is running. You can choose that the price will either go up or down and bet your BNB on one of those. The amount bet by all users on each side determines the payout ratio. You basically have a 50/50 chance of winning each round. However, if the round ends with the exact starting price of the round, the house wins those tokens. As I said, this can be fun but it really is a gamble. The user interface is really cool for this though.

NFTs

The latest addition to the PancakeSwap ecosystem is NFTs. It actually just launched a few days ago. If you don’t know what NFTs are, I’ll go into more detail in another post, but they are essentially collectible items that are on the blockchain. Usually, this is some type of art. The blockchain record acknowledges you as the owner of this item and you can buy and sell these items. Think of these like baseball cards. Collectors will pay a premium for rare cards. There are sometimes many cards produced, but the less common a card the more valuable it usually is. This is how NFTs work. Basically, like baseball cards, they have value because collectors are willing to pay for them.

How Access PancakeSwap?

I may go super in-depth on how to do this in a future post, but I’ll give you the overall steps to help you participate in the PancakeSwap ecosystem. This may seem a bit complicated, but once you figure it out the first time, it’s pretty easy to do after that.

The first step is to set up a non-custodial wallet or one that you own the keys to. I recommend Trust Wallet for this but you could also use MetaMask. Trust Wallet supports the Binance Smart Chain by default, but you’ll have to add BSC to MetaMask.

Once you have a wallet set up, you need to purchase some BNB tokens. These are the tokens from Binance. You can buy these at [eafl id=”1271″ name=”Crypto.com” text=”Crypto.com”], [eafl id=”1269″ name=”Binance.us” text=”Binance”], or one of my other favorite crypto exchanges. You can also buy these directly in Trust Wallet through a provider like [eafl id=”1279″ name=”Simplex” text=”Simplex”]. Once you obtain the tokens, you need to transfer them to your wallet.

The tokens you receive in your wallet will be BEP-2 (the main Binance Chain) tokens and you need to switch them to BEP-20 (Binance Smart Chain) tokens. In Trust Wallet, you simply go to your BNB balance, click the 3 dot menu, and select “swap to smart chain”. If using MetaMask, use the Binance Bridge to convert them. Note: you will have to use a VPN if you’re in the US.

Now that you have converted your BNB to Binance Smart Chain BNB, you’re ready to trade on PancakeSwap. You can go to the exchange and swap your BNB for any of the available tokens. Now you have access to the power of PancakeSwap on the Binance Smart Chain and are part of the future of Decentralized Finance!

Conclusion

I hope you enjoyed this introduction to the world of Decentralized Finance on PancakeSwap. This is just one of the many Decentralized Exchanges on the many different Smartchains that are being developed. Once you get your feet wet, you can branch out into other ecosystems like Cardano, Solana, and Ethereum.

Decentralized Exchanges are sure to make a big impact on the world of finance for the foreseeable future.

Remember, “the moon is made of pancakes”